Employee benefits renewal season always arrives sooner than you expect.

One moment, you’re immersed in daily tasks. Suddenly, your inbox fills with reminders, and the questions begin swirling: Is our employee benefits renewal truly competitive? Did we cover all the gaps in last year’s employee benefits review?

HR teams and business owners know this feeling well. Stress rises, options seem endless, deadlines creep closer. But renewal season doesn’t have to mean chaos. With the right approach, it can be a turning point.

In this article, we’ll guide you through what to evaluate during the renewal process.

You’ll get a practical annual benefits renewal checklist and smart PEO benefits renewal tips to help you build a stronger plan. Along the way, you’ll get expert advice from EquityHR, your trusted partner for smarter benefits.

Key Takeaways

- Start your employee benefits renewal early to avoid rushed decisions.

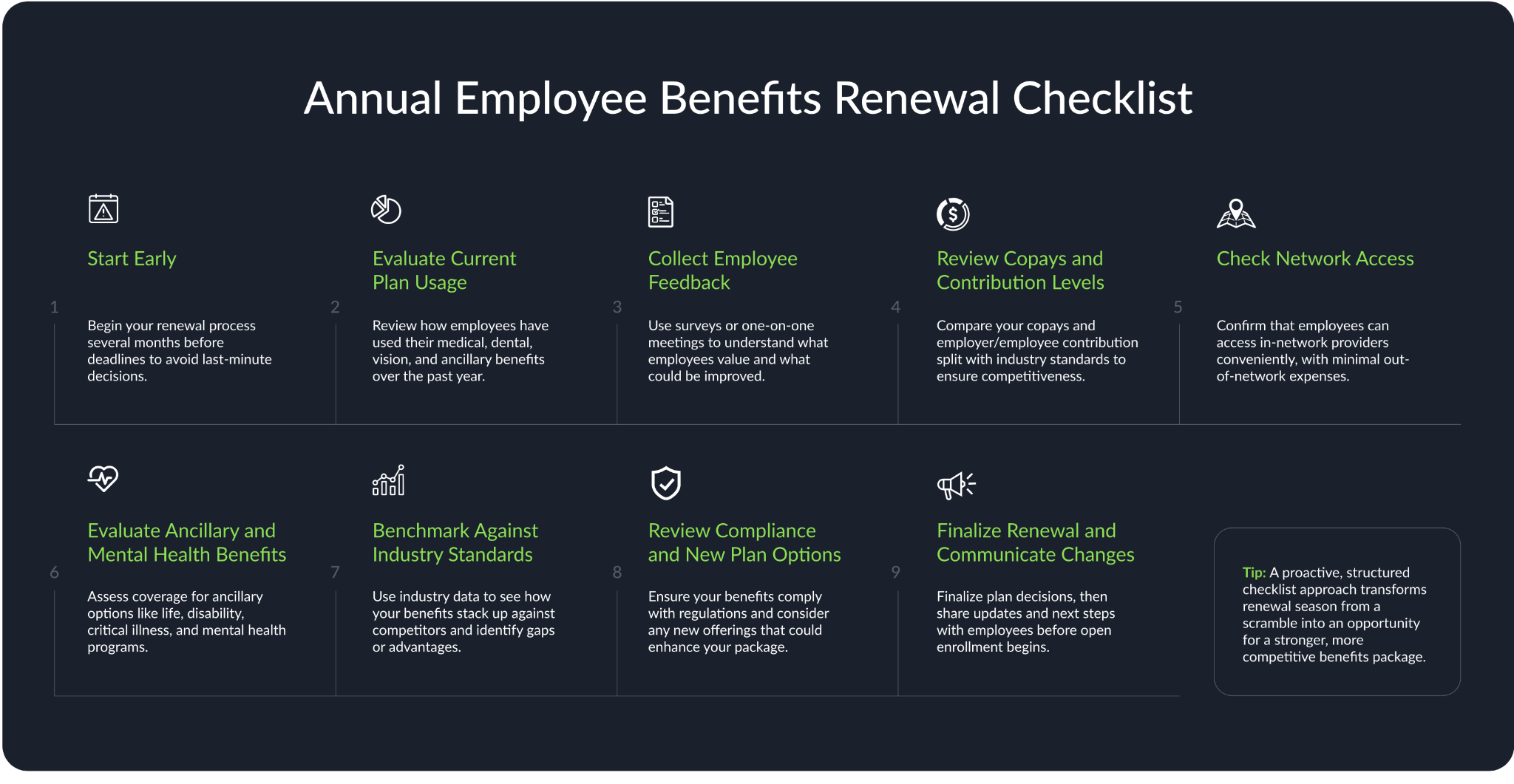

- Use an annual benefits renewal checklist to spot gaps and missed opportunities.

- Compare your contribution levels and copays with industry benchmarks.

- Expand your benefits package to include mental health and ancillary coverage.

- Gather employee feedback to guide your benefits review and planning.

- Partnering with a PEO like EquityHR brings expert negotiation and compliance support.

Why Renewal Season Matters More Than You Think

Every business faces renewal season. Some see it as a routine. Others recognize an opportunity. This window allows you to shape the employee experience for the entire year.

Employee benefits renewal gives you a moment to rethink what your team truly needs. Benefits are powerful. They drive satisfaction, and they shape loyalty. When employees feel their needs are met, they stay. They give their best effort. They tell others why your company is worth joining.

A quick review rarely tells the full story. Use this time to dig into your annual benefits renewal checklist. Examine your plans, compare your contributions, and listen to what employees are saying.

A PEO like EquityHR can make this process easier. We manage the details, provide industry benchmarks, and help you streamline open enrollment planning. With expert guidance, renewal season becomes a chance to set your business apart and keep your team strong.

Are Your Copays Competitive in Today’s Market?

Copays may seem like small numbers on a spreadsheet, but they can have a big impact on how employees actually use their benefits. When copays are too high, people start to hesitate, and they skip checkups.

They delay care. Over time, small barriers like these affect satisfaction and even retention.

Employee benefits renewal season is the right time to compare your plan’s copays with industry benchmarks. Ask yourself: Are your copays aligned with what other employers are offering? Are they affordable for your team? If not, you may be losing value without realising it.

A practical approach is to review copay tiers across your medical, dental, and vision plans.

Look at the range of options available. Small adjustments here can encourage employees to use their benefits with confidence.

Partnering with EquityHR gives you access to real market data. You can see exactly where your plan stands. With the right information, you can make confident decisions that help employees and your business thrive.

Evaluating Contribution Levels: Are You in Line?

Contribution levels mean how much the employer covers versus how much employees pay. They shape the value of your entire benefits package. This balance affects your company’s budget as well as the take-home pay and satisfaction of every team member.

Get it right and you send a message that your business invests in its people. Miss the mark and you may see employees hesitate to enroll or even look elsewhere.

If you’re working with a PEO, your contribution strategy is regularly reviewed using live market benchmarks. During renewal, the PEO provides recommendations based on cost trends and employee needs, saving you time and helping you stay competitive without starting from scratch.

For example, many companies follow a 70/30 or 75/25 split with the employer covering the larger portion. Some industries even stretch that further to attract and keep top talent.

Here’s what to consider as you review your contribution levels:

- How does your employer and employee split compare with industry standards?

- What is the total out-of-pocket cost for employees, including dependents?

- Are high employee contributions causing financial strain or limiting enrollment?

- How does your benefits budget affect your ability to offer stronger coverage or ancillary perks?

- Are there ways to rebalance contributions to boost retention without overstretching your budget?

Take the time now to examine the numbers. With the right data, you can create a benefits package that is fair, competitive, and sustainable.

Go Beyond Medical: Expand the Benefits Suite

Health coverage is the foundation, but the most attractive employee benefits packages do not stop at medical, dental, and vision.

Today’s workforce expects more. They are looking for plans that consider every aspect of well-being, from financial security to peace of mind.

When you expand your benefits suite, you open new doors for employee satisfaction and loyalty. You show your team you’re listening, and you’re ready to support their lives outside the office as well as inside it.

What Are Ancillary Benefits?

Ancillary benefits add extra protection and support for employees, going beyond standard medical, dental, and vision insurance. These options help cover situations that core plans often miss, offering real peace of mind. Here are some common types of ancillary benefits:

- Hospital Indemnity Insurance: Provides cash payments to employees when they are admitted to the hospital, helping cover unexpected expenses like transportation, meals, or childcare.

- Life Insurance: Pays out a lump sum to an employee’s chosen beneficiaries in the event of their passing, offering families financial stability during a difficult time.

- Short-Term and Long-Term Disability: Replaces a portion of an employee’s income if illness or injury keeps them out of work for weeks or months.

- Accident Insurance: Delivers financial support for medical costs related to accidental injuries, from emergency room visits to physical therapy.

- Critical Illness Insurance: Pays a lump sum if an employee is diagnosed with a serious condition such as cancer, heart attack, or stroke, helping cover treatment or living expenses.

- Dental and Vision Buy-Up Plans: Allow employees to choose higher coverage limits for more comprehensive care.

- Wellness Programs: Can include gym memberships, smoking cessation programs, or health coaching to promote healthier lifestyles.

Adding ancillary benefits lets you address more needs without dramatically raising costs. During employee benefits renewal, consider which options matter most to your team.

Source: Investopedia

Medical, Dental, Vision Isn’t Enough Anymore

Not long ago, offering medical, dental, and vision coverage made your benefits package feel complete. Times have changed. Employees now look for workplaces that support every part of their lives. Basic health coverage is expected.

Trends across industries point to a new direction. Workers want benefits that go further.

They value financial wellness programs, mental health support, flexible schedules, and voluntary perks like pet insurance or student loan repayment. Employers who offer these extras are gaining a real edge.

During employee benefits renewal, take time to spot the gaps in your current plan. Ask what your team truly values. The companies attracting top talent are those who listen, adapt, and offer more than just the basics.

Expanding your benefits suite is becoming the standard for building a motivated, resilient team.

Prioritizing Mental Health Support

Mental health is a critical piece of a truly competitive benefits package. Employees bring their whole selves to work. When stress builds or life throws challenges their way, your company’s support can make a real impact.

Start with the basics. Employee Assistance Programs connect staff to counseling and resources for personal or family challenges.

Many teams are now adding teletherapy services, which remove barriers by offering appointments from anywhere. These options make help accessible, reducing stigma and encouraging people to seek support early.

Pay attention to feedback during your annual employee benefits review. Employees value plans that support their mental health just as much as their physical health.

By investing in mental wellness resources, such as meditation programs, resilience workshops, or direct access to licensed therapists, you show your team you care about every aspect of their well-being.

Source: Firmspace

Are Your Employees Using the Network They Need?

Network coverage is often the detail that determines whether a benefits plan works well in real life.

When employees struggle to find their preferred doctors or must travel far for care, even the best coverage loses its value. Out-of-network costs add up quickly, leaving employees frustrated and less likely to use their benefits at all.

In-Network Limitations Can Undermine Plan Value

Take time to review the network details in your current plan. Are employees able to find doctors, specialists, and hospitals near them? Are there complaints about access, unexpected bills, or restrictions?

These are warning signs that your network may not be serving your team as well as it could.

A practical step is to survey employees during your employee benefits review.

Ask them if they are satisfied with the network. Find out if there are locations, specialists, or services that are hard to access. Honest feedback here can help you catch issues before they become bigger problems.

Carrier and Network Reviews Are a Must

Every year, review your carrier options and their provider networks. Do not settle for “good enough.” Look for persistent complaints or patterns in the data. If employees are regularly running into roadblocks with certain providers, it is time to raise the issue with your carrier or consider a change.

Partnering with EquityHR gives you access to benchmarking tools and market data.

This helps you make informed choices and find plans that truly fit your team’s needs. A benefits plan works best when everyone can use it without barriers or surprises.

Let Employee Feedback Guide Your Benefits Strategy

Renewal season used to mean flying blind. Decisions happened behind closed doors. Employees took what was offered, even if it didn’t fit. But times are changing.

Today, you listen. You ask questions before you act. You show your team that their opinion matters, turning uncertainty into a real partnership. A well-timed survey brings focus. When you work with a PEO, we help build and interpret these surveys so that the feedback actually guides plan improvements.

The result: practical changes based on real data, not just guesswork or assumptions.

Sample survey questions to consider:

- Which of our current benefits would you keep?

- Are you missing any benefits that you had at previous jobs?

- Do you feel confident navigating our provider network?

- Have you used our mental health resources?

- Which additional benefits would improve your work-life balance?

- What is one change that would improve your overall benefits experience?

Benchmark Against Industry Standards

Markets shift quickly. Benefits that felt competitive last year may fall short this renewal season.

Employers quietly adjust, seeking the right blend of cost and value. Sometimes, this means dental upgrades, and other times, it means new wellness options.

Benchmarking is your roadmap. Reviewing industry standards reveals how your cost-sharing, plan design, and optional extras compare. Maybe your vision plan stands out, but your contribution split could use a refresh. The data points to what matters most.

A PEO such as EquityHR handles this for you. With access to real benchmarking data and trends across industries, you don’t need to manually compare plans or scour for updates. We show where your offerings measure up and where adjustments can add value.

Adjustments based on facts, not guesses, keep your benefits package aligned with your goals.

Stay ahead of the curve. Let benchmarking shape a benefits package that works for your people and helps you compete for the talent you need.

How EquityHR Supports Smarter Benefits Renewals

Choosing a partner for your employee benefits renewal makes a real difference. EquityHR brings expertise, data, and support every step of the way. Here is how our team helps you succeed:

- In-depth Plan Reviews: We analyze your current benefits package to identify strengths, gaps, and opportunities for improvement.

- Carrier Negotiation: Our experts negotiate directly with insurance carriers to secure better rates, stronger plan options, and tailored solutions that fit your team.

- Industry Benchmarking: We provide real-time data, showing how your benefits stack up against competitors. This helps you stay competitive and attract top talent.

- Employee Feedback Integration: EquityHR helps you gather and use employee input to fine-tune your benefits strategy and address real needs.

- Open Enrollment Planning: We handle the details, from clear communication materials to step-by-step enrollment support, making the process smoother for everyone.

- Compliance Support: Our specialists keep your plans compliant with changing regulations, reducing risks, and protecting your business.

- Ongoing Support: You have access to a team ready to answer questions and solve issues throughout the year, not just at renewal.

With EquityHR, your business can focus on growth while we manage the complexities of employee benefits. Smarter renewals mean happier teams, lower turnover, and benefits that make a difference.

Is Your Renewal Strategy Working for Your Team?

Every decision you make during employee benefits renewal shapes the year ahead. Are your plans actually meeting your team’s needs? Do your benefits help you stand out and keep your best people?

Now is the time to move from routine renewals to a strategy that puts employees first and makes your life easier as an HR leader or business owner. Data, benchmarking, feedback, and expert support can transform how your team experiences benefits.

If you want more insight, clarity, and support in your next renewal season, EquityHR is ready to help. Our team brings years of experience, carrier relationships, and compliance know-how to the table, allowing you to focus on your people, not paperwork.

Take the next step. Make your next benefits renewal your strongest yet. Contact EquityHR today to see what’s possible.

FAQs

What do I need to concentrate on when renewing employee benefits?

If you’re working with a PEO, you don’t need to handle every detail yourself. The PEO evaluates plan usage, gathers employee feedback, and compares cost-sharing with benchmarks on your behalf.

Instead of juggling renewal checklists on your own, the PEO handles this process and brings recommendations that fit your budget and your team’s needs.

What will an employee benefits review do to increase retention and satisfaction?

Employee benefits review will enable you to know what is important to your team. Survey responses, plan usage, and market trends can be used to customize what you provide to meet the needs of employees.

This process shows you what is working and where there are gaps so that you can make modifications. Consistent analysis in the renewal season makes your benefits package competitive and makes sure that you are experiencing high levels of retention and employee satisfaction.

What should be on an annual benefits renewal checklist?

The annual benefits renewal checklist should cover a review of your medical, dental and vision plans, contribution split, ancillary and mental health benefits, and provider network coverage. Include the stages of benchmarking with other companies of similar profile and employee feedback.

Review compliance news and new plan choices. This checklist will turn renewal season into a systematic procedure that will guarantee that your employee benefits are valuable and competitive year after year.

Why are PEO benefits renewal tips important for small businesses?

PEO benefits renewal tips provide small businesses with expert advice on plan selection, carrier negotiation, compliance, and benchmarking. By partnering with a PEO like EquityHR, you gain access to market data and proven strategies that help streamline renewal season.

These tips are crucial for optimizing employee benefits, saving time, and ensuring your offerings stay competitive.

They can also help uncover cost savings while maintaining strong employee satisfaction.

How does open enrollment planning impact employee benefits?

Open enrollment planning is a critical part of managing employee benefits.

Clear communication, updated materials, and step-by-step support ensure employees understand their options and make informed decisions.

Planning ahead helps avoid last-minute stress, increases participation, and maximizes plan value. Incorporating employee benefits renewal best practices and feedback into your open enrollment process makes your benefits more effective and your team more engaged.